Corporate debt restructuring is a process that involves reconsideration between a debtor and a creditor. The debtor renegotiates with the creditor to reduce the interest rate, extend the repayment term, or lower the loan balance to ease payments.

This is a complex process that involves renegotiating the terms of existing debts, which eventually helps companies and lenders ease financial distress.

The company renegotiates the terms of its financial obligations with creditors. The goal is to help businesses ease financial distress, avoid insolvency, and remain operational.

What is Corporate Debt Restructuring ?

Corporate debt restructuring refers to a company renegotiating repayment terms with creditors to reduce interest rates, extend due dates, or lower the outstanding loan balance to ease financial burdens

How does Corporate Debt Restructuring work?

Sometimes, a business gets into a position where its earnings are not enough to service its debts, or a subject is not in a position to comply with a scheduled repayment plan due to unforeseen circumstances not identified during proposal screening.

In this case, the subject is unable to keep up with repayment. This would call for limited choices, such as restructuring or bankruptcy, and the best option for anyone to go for is restructuring, which is more preferable and cost-effective in the long run.

Differences between Debt Restructuring and Debt Refinancing

Debt restructuring: Debt Restructuring involves altering an already existing contract due to the inability to keep up with the repayment plan.

Debt refinancing: Debt refinancing is the process of starting up a new contract, replacing an existing loan with a new one to secure better terms.

The Benefits and Risks of Debt Restructuring

Debt restructuring can be expensive. Restructuring comes with a cost, which includes a downgraded credit rating, a negative impact on investors, and a higher overall interest payment due to renegotiated terms; however, it can help the borrowers avoid bankruptcy.

Restructuring enables you to address financial challenges while also positioning yourself, either as a company, for future growth opportunities.

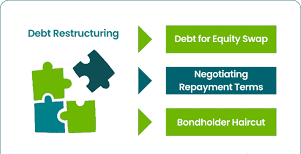

Common Methods of Restructuring

The several ways debtors can renegotiate their financial obligations using restructuring so that they can restore liquidity and continue their operations are;

- Debt for Equity Swap: This is a common process where lenders or creditors agree to waive an outstanding debt in exchange for a stake in the company. This often occurs when the company possesses a substantial asset base.

- Bondholders’ Haircut: In this process, a company seeking to restructure its debt requests that a portion of the interest payment be written off; this portion is referred to as the Haircut.

- Debt Rescheduling: Here, both parties agree to a restructuring of the terms of an existing loan as proposed by the borrower. This is to extend the payment period or refuse the interest rate over a given period while increasing the monthly payments.

- Debt Consolidation: This is when multiple existing debts are combined into a single new debt, which usually comes with more favorable terms. The goal is to simplify repayment and reduce financial burden by securing a lower interest rate or extending the due date.

- Refinancing: as earlier discussed, refinancing in debt restructuring is the process of replacing an already existing loan with a new one starting a new contract.

- Loan Modification: This is simply the process of changing the terms of an existing loan without replacing it or taking out a new one to create a more manageable payment.

- Payment Deferment: In this process, without altering the total debt amount, the lender agrees to postpone scheduled payments for a period, giving the borrower breathing room. This means you can stop making payments without incurring an additional fee.

- Recapitalization: This involves changing both debt and equity in a company’s capital structure to improve financial stability and reduce repayment pressure. The company alters the share composition of its share capital structure to reduce its debt outstanding burden.

- Transfer to Newco: The transfer to the new company process is when the viable assets and operations of a distressed company are moved into a newly created legal entity, leaving behind the unsustainable debt with the old company. This is done to preserve core business values, attract new investors.

- Debt Settlement: This process resolves outstanding debt by negotiating with creditors to allow you to pay less than what you owe. Unless bankruptcy is the only option for you, this may not be an available option.

- Bankruptcy: Often treated as the last option in corporate restructuring, this usually occurs when a company is financially distressed and struggles to meet its debt obligations or when the value of its liabilities is more than the assets.

Having understood that corporate debt restructuring is a strategic approach that involves converting a company’s debt into equity by simply negotiating a reduced interest rate. Now, let’s look at the types of restructuring.

Types of Restructuring

- Operational Restructuring: These are actions carried out to improve a company’s efficiency and productivity, leading to the company’s turnaround. Operational restructuring targets the underlying performance of the company and aims to improve it, focusing on the profitability of operations.

- Financial Restructuring: This involves reorganizing the financial aspects of a business unit, including cash flow streams, capital structure, debt equity, cost of capital, etc. It is concerned with stabilizing the company’s financial position. Financial restructuring experts help businesses navigate the restructuring process by altering the capital structure of a company when it is unable to meet the requirements of existing debt obligations.

Roles of Investment Banks, Creditors, and Restructuring Advisors

Investment Banks: Investment banks are faced with the responsibility of advising companies on complex financial strategies during restructuring.

Key Responsibilities:

- Capital Raising

- Merger and Asset Advisory

- Valuation and fairness evaluation

- Creditor negotiation

- Market Positioning

Creditors: Creditors are available for lending or extending credit to companies and seek repayment while protecting their interests.

Key Responsibilities.

- Protect rights

- Negotiate payment terms

- Monitors the company’s performance

- Weigh the restructuring plan

Restructuring Advisors: They are the operational and financial specialists who help companies stabilize, improve liquidity, and execute turnarounds.

Key Responsibilities:

- Cash flow management

- Stakeholders communication

- Crisis management

- Plan development

- Operational turnaround.

Working together, the investment bank focuses on high-level capital structure solutions and market transactions, while the restructuring advisor manages the day-to-day operational and liquidity issues to keep the company running during the process. Finally, the creditors are counterparts who are necessary for the restructuring to succeed.

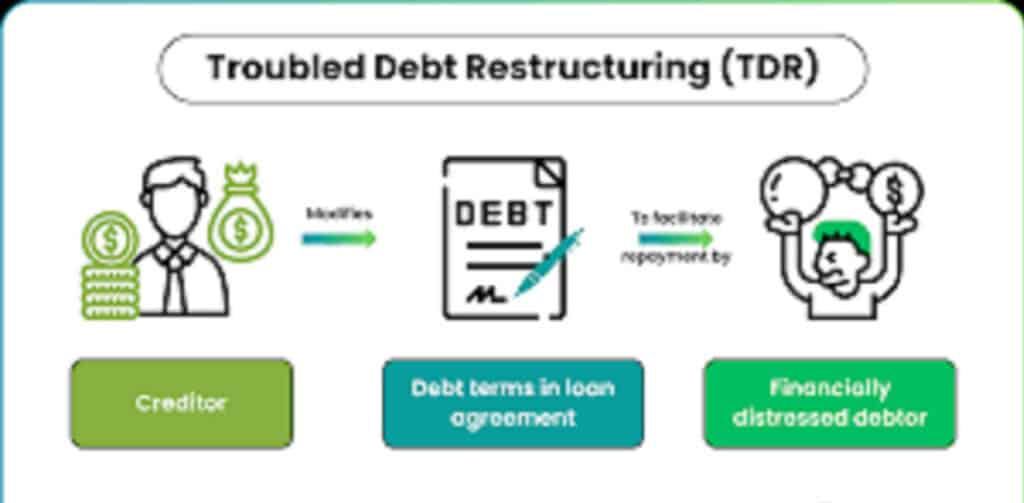

Troubled Debt Restructuring

This is a stage where the terms of the loan are modified, and the creditor grants a concession to the debtor due to financial difficulties faced by the debtor. This process includes a reduction in interest rate, a reduction in the amount of debt, extending the due date, or debt settlement such as transferring assets to the creditor.

Accounting for a Troubled Debt Restructuring

Accounting for a TDR varies, and these are based on the terms of the agreement, which may result in a recognized gain by the borrower. This spans several payment instruments, which include;

- Equity instruments

- Tangible assets

- Intangible assets

- Hybrid securities

Final Thought

Corporate debt restructuring is a practical option for businesses facing financial distress. It helps companies avoid bankruptcy, safeguard jobs, and preserve long-term shareholder value. If you need to restructure your debt terms or plan, consult with a financial advisor or counselor to explore the best options.

Leave a Reply